It was hardly a surprise when attorneys representing various interests in the LeFever Mattson bankruptcy case dragged Tim LeFever into mediation last month.

LeFever is a co-founder of the dismantled company, along with longtime friend Ken Mattson, now accused by federal prosecutors of operating a Ponzi scheme that bilked potentially hundreds of clients out of tens of millions of dollars over at least 15 years.

RELATED: Indicted Bay Area real estate mogul is living in a $6 million house. His creditors want him evicted.

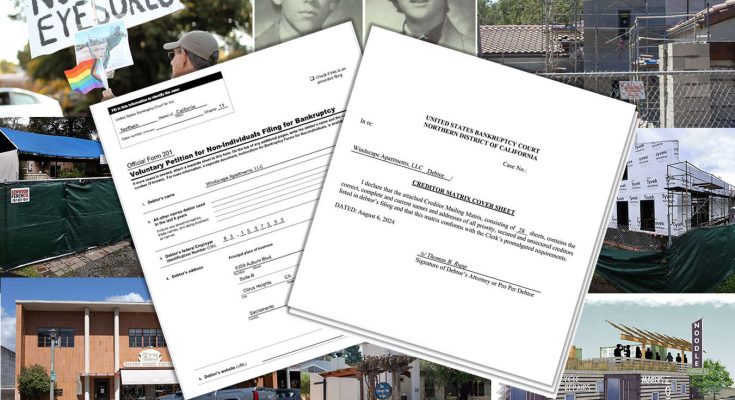

More stunning was an application filed Wednesday by the unsecured creditors committee representing the interests of the more than 600 people who invested in LeFever Mattson’s real estate acquisitions. The committee sought permission to subpoena Tim LeFever’s mother-in-law, alleging that the company transferred millions of dollars to her.

Bankruptcy Judge Charles Novack granted the application the same day.

Kathleen Hamlin is 83 and lives in Dixon, a couple miles from her daughter, Amy LeFever, and Amy’s husband, Tim.

The committee’s subpoena application claims LeFever Mattson transferred more than $2.4 million to Hamlin, including more than $1.6 million in the year leading up to the bankruptcy filing.

The panel now identifies her as a litigation target.

Coincidentally or not, the committee and lawyers representing LeFever Mattson entered into mediation with Tim LeFever this past week.

Neither LeFever nor his San Francisco-based attorneys responded to interview requests over the past week.

The subpoena seeks information not just from Hamlin, but from her accountants, financial advisors, attorneys, employees and/or family members, including Tim and Amy LeFever.

The committee is asking for documents explaining Hamlin’s connection not just to her son-in-law’s former company, but to the Capitol Resource Institute, the Laurel Wreath Foundation, Monley Hamlin Construction and Monley Hamlin Inc.

The first two entities are nonprofits.

The Laurel Wreath Foundation is a little-known organization that according to its 2024 tax returns provides social services, religious activities and educational opportunities for the public. Its address of record is the LeFevers’ home. Tim is listed as the officer of Laurel Wreath, Amy the secretary. It had investment income of just over $1 million in 2024, and expenses of $167,000 — all in the form of grants.

One of those grants, for $60,000 and listed under the heading of “educational opportunities,” was to the Capital Resource Institute, an organization dedicated to parental rights. It has waged battles against same-sex marriage, reproductive rights, comprehensive sex education and critical race theory in schools. Tim LeFever was chairman of the institute in 2017.

Monley Hamlin Construction is a general contractor based in Davis. The company has done a lot of construction work for cities, universities and hospitals, according to its website.

The subpoena also seeks information on any transfers between Hamlin and LeFever Mattson, as well as four related limited partnerships set up as investment vehicles — Autumn Wood I, Country Oaks I, Tradewinds Apartments and Hagar Properties.

Finally, the subpoena requests documentation of Hamlin’s own claim to money invested in LeFever Mattson, the main entity behind what was at its peak a $400 million California real estate empire, now crumbling amid the bankruptcy proceedings and Mattson’s criminal case.

He has pleaded not guilty to a total of nine counts of wire fraud, money laundering and obstruction of justice.

Tim LeFever has not been charged.

Hamlin has until Jan. 9 to complete her document production, and until Jan. 30 to appear for oral testimony, unless the committee agrees to an extension.

In court documents and letters to investors, LeFever has described himself as one of Ken Mattson’s many victims. He filed 61 claims in the LeFever Mattson Chapter 11 case — one for each of the company’s bankrupt entities — and another in the bankruptcy case of KS Mattson Partners, the company Mattson owned along with his wife, Stacy.

LeFever also asserted in the petition to appoint a mediator that he is owed money from his employment at LeFever Mattson, and has claims against KS Mattson Partners based on that company’s “breaches of partnership agreements, aiding and abetting Mr. Mattson’s breaches of fiduciary duty, and constructive fraud.”

It was LeFever who first publicly flagged problems with LeFever Mattson accounting, reporting them in May 2024 to the Securities and Exchange Commission and the Department of Justice.

That has not proved convincing to LeFever Mattson investors or the attorneys representing their interests, who previously subpoenaed him in the bankruptcy cases.

During an online town hall in July, attorney Debra Grassgreen, whose San Francisco firm represents the creditors committee, suggested her firm would seek to “equitably subordinate” LeFever’s interests, which she defined as putting his claims “way down to the bottom of the ladder.”

It isn’t clear whether the mediation process resolved that issue.

A class-action lawsuit against Mattson, LeFever and their various businesses, filed in the U.S. District Court for the Northern District of California in October 2024, devotes an entire section to LeFever’s role in what it calls “the investment scheme.”

It describes him as an active partner who often sent cover letters on behalf of LeFever Mattson to new investors or when selling properties to roll investors into a partnership agreement. That lawsuit, and at least half a dozen others, have been paused by the bankruptcies.

Working on behalf of both LeFever Mattson Inc. and KS Mattson Partners, Ken Mattson took the lead on acquiring around 200 properties, with an overall value of approximately $500 million. Prosecutors now contend he funneled millions of dollars into his own bank accounts. His criminal case has yet to go to trial.

You can reach Phil Barber at 707-521-5263 or phil.barber@pressdemocrat.com. On X (Twitter) @Skinny_Post.