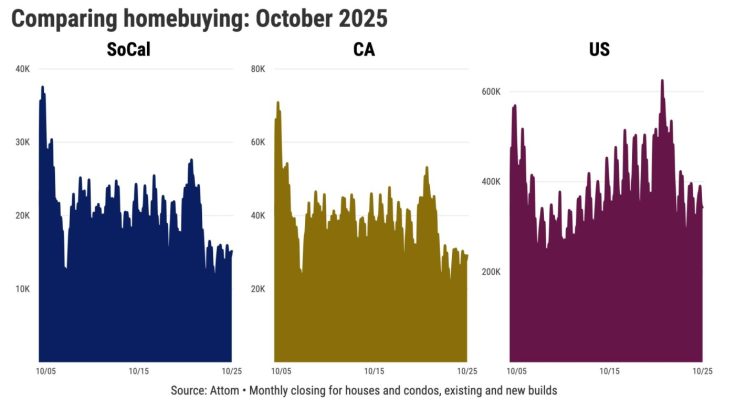

California house hunters aren’t in a buying mood, pushing statewide sales to their fourth-slowest October in 21 years.

Across California, there were 29,379 closed sales of houses and condos, both existing residences and newly constructed, in October, according to real estate tracker Attom. That homebuying activity was off 2.2% in a year and 22% below the month’s average since 2005.

House hunters may be modestly encouraged by mortgage rates dropping off their recent peaks. However, the reasons behind declining financing costs – economic uncertainty – aren’t exactly motivating many folks to close a sale.

Taking a longer view, California buyers are somewhat more active.

In the past year, sales totaled 324,475, up 2% from the previous year. Yet that’s 26% below the 21-year average.

Price is wrong

California house hunters balk as prices remain lofty.

October’s California median selling price of $735,125 was off 0.5% in a year but the benchmark remains only 2% – or $14,875 – below the $750,000 high of May 2024.

Even a significant cooling of price appreciation isn’t inspiring house hunters.

Prices are up 9% the past three years after surging 35% over the previous three. That boom was driven by the pandemic’s economic gyrations, including historically low mortgage rates and a thirst for bigger living spaces.

In early 2022, the Federal Reserve began raising the interest rates controlled by the central bank to address the worst inflation in four decades. By 2025, the Fed changed its approach and started lowering rates to support a wobbly economy.

Who can buy?

It’s all about the house payment.

Mortgage rates averaged 6.4% in the three months ended in October. That’s flat in a year, but a full percentage point off the recent high of 7.4% in November 2023.

Combine those rates and recent pricing patterns, and you see that October’s typical California buyer had an estimated monthly mortgage payment of $4,597. That’s flat in a year and 8% below June 2024’s recent high.

Still, this buying burden is up 101% in six years – and don’t forget the $147,025 needed for a 20% down payment to get these payments.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com